Health is Wealth

The proverb “health is wealth” is meant to emphasize that good health is more valuable than money. Today, it could be taken literally. Hospital and healthcare centers are the second-largest industry by revenue in the country. The first? Health insurance. Health is indeed wealth.

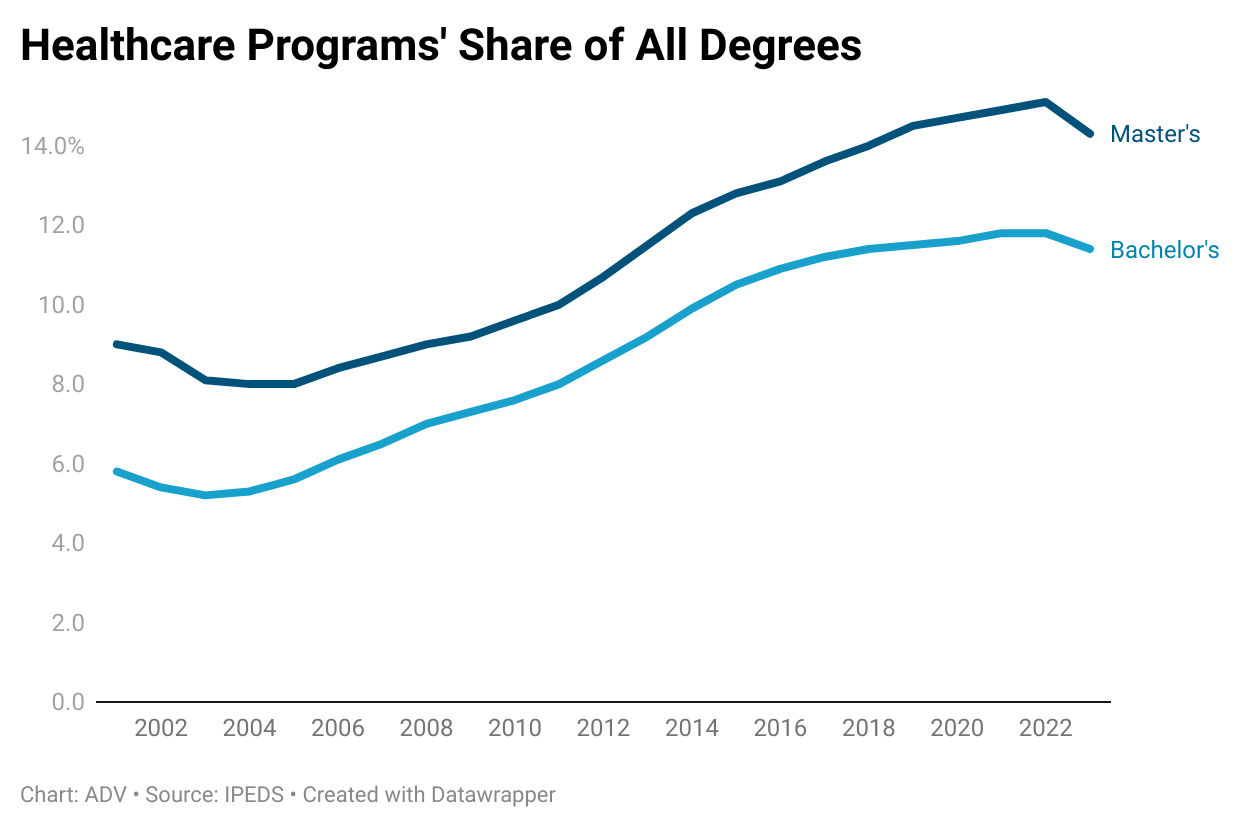

Healthcare programs have also become a meaningful source of enrollment and revenue in higher education. In 2003, just one out of every twenty bachelor’s degrees was in a healthcare field. By 2023, that number had grown to one in nine. At the master’s level, one in seven degrees is now healthcare-related. That share continues to climb.

The drivers are clear. In July alone, three out of every four jobs added in the U.S. were in healthcare. Maybe read that sentence one more time – 3 out of 4 jobs.

Over the past year, healthcare, social assistance, and government accounted for nearly 70% of all new jobs while most other sectors shrank. With 20% of the U.S. population projected to be over 65 by 2030, the need for care is only accelerating.

Healthcare programs are particularly attractive at a moment when other fields are being disrupted by AI. For most of the past two decades, a degree in Computer Science wouldn’t have just guaranteed you a job, it would have made you wealthier than nearly all of your peers. But today, many entry-level tech roles are being absorbed by AI, leaving graduates to compete for fewer openings. This year, Computer Science had the 7th-highest unemployment rate for recent college graduates among all majors.

Healthcare, by contrast, feels “AI-safe.” While AI is changing how care is delivered, the practice of healthcare—hands-on, human, relational—is unlikely to be replaced.

The implications for higher education are broad:

Opportunity Cost: If you’re not offering programs in healthcare fields, you are closing yourself off to 11% of the undergrad market and 14% of the master’s degree market, shares that are only expected to grow in the future.

Portfolio Balance: As more students gravitate toward healthcare, institutions may see softer demand in other fields that once benefited from “safe choice” status—business, communications, even some STEM areas.

Institutional Perception: A strong healthcare presence signals an institution is relevant and future-focused.

Messaging Opportunities: Growth in healthcare programs isn’t a story about healthcare alone. It’s also about how student preferences are shifting. Institutions that understand this will adjust not only their messaging, but also how they frame the rest of their academic portfolio. For enrollment marketers, this may mean experimenting with new ways of storytelling: positioning business or tech programs as healthcare-adjacent (data analytics for health, healthcare management, medical technology).

Operational Realities: Clinical placement and faculty shortages remain the biggest bottlenecks to healthcare program expansion. Marketing and admissions teams must avoid overpromising in constrained environments. Institutions that solve these constraints through partnerships, simulation labs, or creative scheduling will build enormous brand equity.

To be clear, healthcare programs are not dominating campus enrollments – for every undergrad majoring in healthcare, there are eight others studying something else. But healthcare’s steady rise tells us something important: student preferences are shifting toward fields that feel safe, lucrative, and meaningful.

Institutions seeking growth and demand would be wise to consider investments in preparing health practitioners and the staff that support our country’s healthcare enterprise. The combination of economic, demographic, and social trends in the U.S.; growing focus on higher ed ROI; and AI disruption mean more students will consider careers in healthcare. College enrollments will reflect that.